DRIVESMART: The Questions To Ask About Car Finance

We explain the questions you need to ask about car finance deals

The Questions To Ask About Car Finance

30 September 2020

Is a tempting finance deal too good to be true?

We explain how to get the facts about car finance offers.

So you spotted the car of your dreams and there's a tempting finance offer.

But just how do you know if that finance deal is really the right one for you?

We set out the questions to ask your car dealer or broker so you can choose the right car finance deal.

But before we do that, it's worth taking the time to decide your priorities for finance.

Do I Really Need Finance?

The answer might be simple - if you don't have the money to pay cash then finance may be the only way to get the car you want.

But if you do have savings, ask yourself:

- What's the after-tax interest rate I'm getting on my savings?

- If I use my savings, how quickly can I replace them?

- Do I have sufficient savings to cover an emergency spend?

With Question 1 you're actually looking at the real cost of finance to you.

If you've got a nest egg tucked up and earning a good after-tax rate of interest then this makes the real cost of using finance less expensive.

Conversely, if your savings are earning a tiny amount of interest then using finance will be proportionately more expensive - you can't get enough in your investment return to pay for the interest on the finance deal.

In that case, using your own cash reserves may be cheaper than finance, but now ask yourself Question 2, because if you can't recharge your savings account quickly then you're exposed to risk from unexpected costs.

And that leads on to Question 3; what's the likelihood of the need for emergency cash, maybe for a home repair or due to a loss of income in your household?

Look back over the last few years at the causes of unexpected outgoings or loss of income and ask if you will have enough to cover similar events if your savings are tied up in a car.

If you've satisfied yourself that you have the cash to spare on your car then using finance may not be the right answer for you.

But if spare cash isn't available, or could be hard to replace, then finance may be your only route to your next car.

In either case, you need to be asking the car dealer or broker the right questions, so let's get started on them.

What's The Price For Cash?

That may sound like a simple one, but many car dealers an online brokers are now offering two different car prices, one for cash payment and one for finance and, typically, the financed price is lower than the cash one.

Why? Well, the finance company will make money from you through interest charges on the money you borrow and it's prepared to hand back some of that money to you as an incentive to take finance.

So, if the finance price is substantialy less than the cash price .....

Could I take Finance And Pay It Off Early?

This is one where you need to read the small print, but basically it boils down to your statutory rights when taking finance that's regulated under consumer protection law.

Your car dealer or broker is obliged to tell you your rights under the finance agreement and these will include those over terminating the agreement early.

Put simply, you could take a car on finance, get the benefit of the lower finance price and then pay off the finance early without losing the benefit of the cheaper price.

The topic is one we'll cover in detail in a future blog as it's worth an entire article to explain how it works, but just be aware that the finance price could, in effect, be the cash price too as long as you know how to work the deal.

What Are My Finance Options?

Your car dealer or broker may have a tempting deal on offer, but you need to know what other finance they could provide.

Typically a dealer will offer Hire Purchase, personal leasing (often called Personal Contract Hire or 'PCH') and Personal Contract Purchase (or 'PCP').

Get the dealer/broker to provide quotes for each of these - a good dealer will do it anyway so you can compare the monthly payments and total finance costs side-by-side.

And if those quotes are markedly different, as why.

It's not unusual for manufacturers to offer much better discounts in finance products such as Personal Contract Hire because the discount doesn't need to be disclosed to you.

And that means you're less likely to be tempted to ask for the same discount for cash.

Finally on this point, don't be afraid to take away the comparative quotes to think about.

When you do that, why not also get a quote from your bank?

Your bank will know your financial capabilities as well as you do from your account transactions and therefore it will know your creditworthiness too.

The bank will therefore also know how low it could go in interest rates on a bank loan based on your financial reliability, and that rate could be lower than a dealer or broker finance deal.

What Is The Deposit?

Make sure you understand the deposit or initial payment requirements.

It could be a simple cash amount (e.g. £1,000), or a percentage of the purchase price, or perhaps a multiple of the normal monthy payments, say 3 payments in advance.

Sometimes a finance deal will require a significant deposit (say, 50%) so, whatever it is, make sure you've got it and the deposit won't leave you stretched financially.

What Are The Monthly Payments?

It sounds silly, but make sure you know and can compare the monthly payments for all the finance options at your disposal.

Some finance deals have low monthly payments, but that's because they require either a high deposit or, like PCP, they keep a lot of the purchase price until the end of the deal, when you have to make a large lump sum payment to own the car.

Others have a low monthly payment because, like PCH, you don't have to pay the full price of the car, but you will never own it either (it goes back to the finance company at the end of the deal).

What Are The Total Payments?

Make sure you have a fully worked example of the total payments over the life of each type of finance agreement, including any final payments to take ownership of the car.

And think about how you will afford that final payment - if it's high you may have to hand back the car anyway or re-finance it to be able to get ownership.

What Will The Dealer Earn?

Some people are embarrassed to ask, but the dealer/broker isn't offering you finance for nothing, so find out how much they are earning in finance commission for the deal.

Some charge a fixed finance arrangement fee, others take a commission based on the total interest you pay, and others get both.

Some also get additional commission based on how many loans they arrange or how much their customers have borrowed in total over the year.

So make sure you know how much the dealer will earn on the deal from every angle, because you can then ask for some of it back or off the price of the car. Yes, why not?

Is It Really Worthwhile?

Asking all these questions? Definitely!

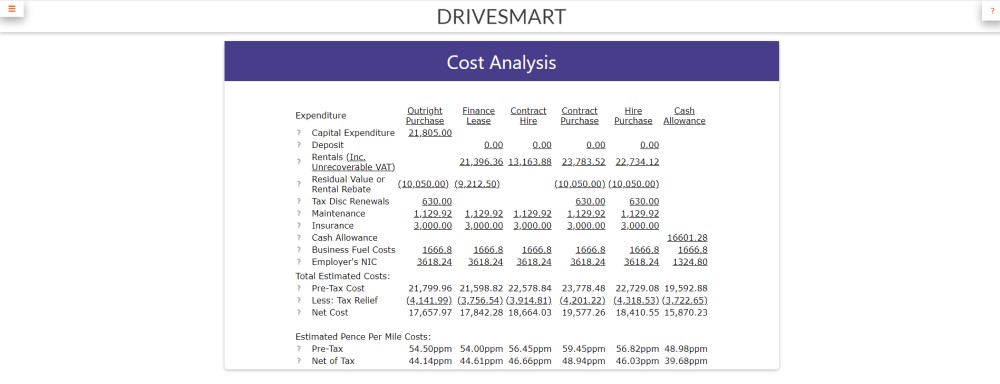

To see just what a difference your funding options could make to the cost of a car finance deal take a look at our 'Lease or Buy' calculator.

We'll show you worked examples of the costs of finance including HP, PCP and PCH so you can see for yourself what a difference each type of payment can make.

Related Tools

Related Posts

What Else Do We Do?

DriveSmart has a unique suite of free online tools to help you find the right car.

Take a look at some of our amazing calculators and decision tools for new car buyers.

-

Lease or Buy?

Could you lease a new car for less than the cost of buying? Our lease calculator will work out the best finance method for you. -

ICE or Electric?

Would an electric car be cheaper than petrol or diesel? Our ICE or electric calculator compares running costs instantly. -

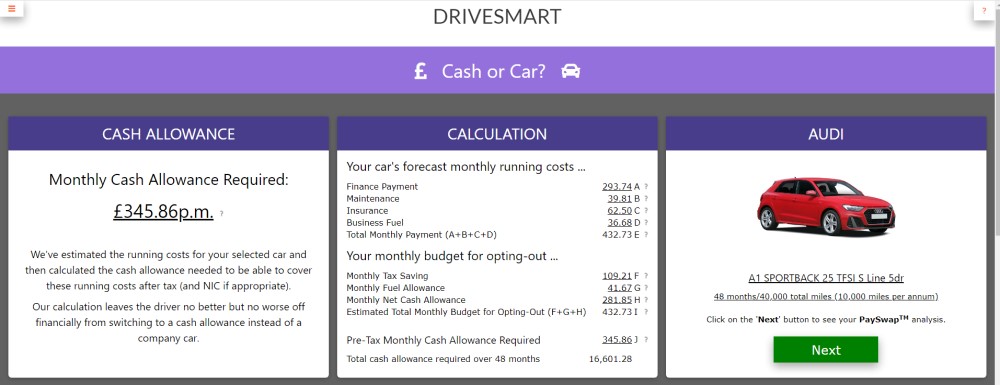

Cash or Car?

Could you give up your company car for a cash allowance? Our 'cash or car' calculator will tell you. -

Car Search

Find your next new car by monthly payment, standard equipment, performance, economy and more .... -

DriveSmart

Why not visit the DriveSmart website and see for yourself the amazing range of tools and analysis? We'll keep your place here while you browse.