DRIVESMART: Cash Allowance

Dealing with the practicalities ....

Cash Allowances - Making It Work For You ...

11 August 2020

So, you've taken the cash allowance, now how do you make it work for you?

We explain the practicalities of taking a cash allowance when you've been used to a company car.

You're Ready To Go ...?

You've chosen your new car and you're ready to get motoring.

Whoa! Not quite yet.

This time you'll be taking delivery of your own car, not a company car, so you're responsible for it in every sense.

You make the monthly payments, you insure and tax it and, if it goes wrong, you're the one who'll be sorting it out.

So, in the words of Juile Andrews, let's start at the very beginning ...

Delivery

When you take delivery of your new car, make sure you:

- Examine the body work - check for pre-delivery damage such as stone chips to the paint or scuffs to the interior, exterior or wheels and tyres.

- Check everything's there - make sure everything you ordered as factory or dealer options has been fitted and double check items such as the toolkit, spare wheel/tyre inflation kit and that you get all the keys.

- Get the delivery driver to show you that everything is working - all equipment, options, lights, in-car entertainment etc, and don't accept excuses that the driver needs to get away to the station to make a train.

- Drive it - and not just to the station to drop off the delivery driver - to make sure there are no obvious defects in the way the car runs.

- Don't be afraid to reject the car if there's something wrong or missing - this time it's your money that's being spent.

And remember that delivery is just the beginning.

What's Next?

You're now responsible for:

- servicing and maintenance

- MOTs and renewing the tax disc

- making sure that warranty work is done and that manufacturer recalls are processed; and

- that the car is kept in a roadworthy condition, especially when it's being used on business travel.

You'll also need to keep up with insurance renewals each year and that includes making sure you're covered for business journeys, or at least commuting to work if you don't plan to use the car for actual business travel.

And there's one more factor to consider ...

Taxation

With a company car the taxes are typically computed for you. Your employer sends details of your car to HM Revenue & Customs and they adjust your PAYE code to catch the tax due every month through the payroll.

When you take a cash allowance you will need to sort out the tax arrangements.

First job is to tell the tax office that you no longer have a company car, which will increase your PAYE tax code (that's a good thing), as the company car benefit will no longer appear.

The next job will depend on how your employer is providing your cash, for example:

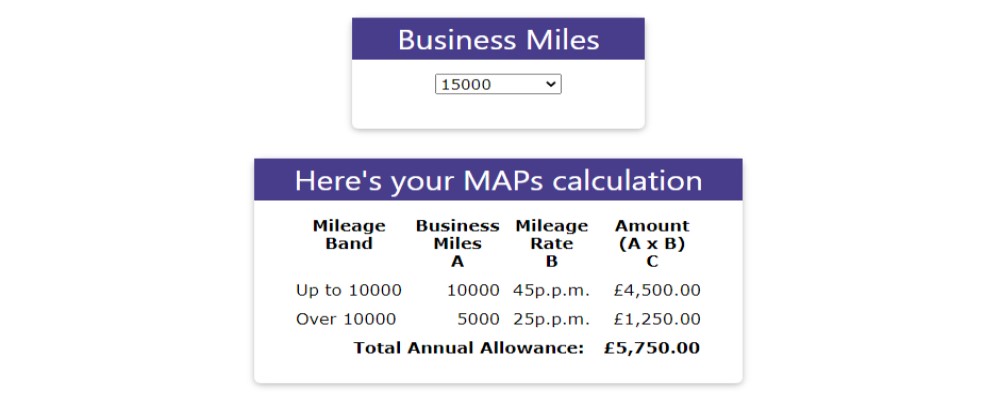

- You get a mileage allowance to cover business travel and this is in line with the full rate of HMRC's mileage allowances; there's nothing more to do.

- You only get a mileage allowance to cover fuel on business travel; then you may be entitled to claim additional tax relief for other costs such as depreciation, maintenance and insurance.

If you are claiming tax relief direct with HMRC under 2. above then you don't have to wait until the end of the tax year to make a claim.

You can ask for your PAYE code to be adjusted at any time during the tax year to take account of your forecast business mileage for the year and get the benefit of paying less tax each month through the payroll.

To check your tax relief claim just use our tax relief calculator - it will work out for you the amount of tax free mileage allowance or tax deduction you can claim each year.

You're On A Merry-Go-Round

Eventually it will be time to change your car, and this means going through the entire cash or car process again.

Check that the terms of your employer's cash allowance haven't changed, and get familiar with the changes if they have.

You'll also need to deal with the return process for your car, depending on what type of finance deal you took to fund the vehicle.

Irrespective of how you financed the car:

- Check the service log book has been marked up for all your service history and get any missing stamps in the book.

- If your car will be returned around the 3rd, 4th or later annivesary of the initial registration, ensure you book an MOT test in time to get any defects fixed before the car is returned.

- If your car is still under a manufacturer's or other warranty, get the MOT inspection well before the warranty expires in case you need to make a claim for items that fail the MOT (but remember that the warranty won't include fair wear and tear).

- Get the car checked for damage to the bodywork, wheels, interior or equipment - you may be charged by your leasing/finance company for returning the vehicle with excessive wear and tear to these items. If necessary, liaise with the lender to have an appraisal before the vehicle is sent back

If you've taken a PCP finance deal, check the current market value of the vehicle.

If the car is worth more than the final payment/minimum future value in your PCP agreement you may have money in the car.

You can roll this money forward into the cost of your next car, either by selling your existing car privately or using the surplus value as a trade-in deposit towards the next one.

If the car is worth less than the final payment/minimum future value in your PCP agreement then, as long as this is not due to excess wear and tear, with typical PCP arrangements you can simply hand back the car and that's the end of the deal as far as you are concerned - the 'loss' is the dealer or finance company's responsibility.

Staying On Top

As with any aspect of your employment, make sure you keep up-to-date with:

- vehicle models and fuel types - the market is changing radically right now with hybrid and electric vehicles coming to the fore;

- employment and tax law revisions - the tax rules which might have made a cash allowance favourable when you took it could have changed by the time your car is being replaced; and

- employment practice - employers will change their policies and procedures about company cars and cash allowances in response to market behaviour and employment/tax law.

Remember too that this article is focussed on just the key steps involved in taking a cash allowance.

There's a lot more detail to be covered when you embark on the process, so check all available sources of detailed information and analysis at every stage.

Don't be afraid to ask for help!

Related Tools

Related Posts

What Else Do We Do?

DriveSmart has a unique suite of free online tools to help you find the right car.

Take a look at some of our amazing calculators and decision tools for new car buyers.

-

Lease or Buy?

Could you lease a new car for less than the cost of buying? Our lease calculator will work out the best finance method for you. -

ICE or Electric?

Would an electric car be cheaper than petrol or diesel? Our ICE or electric calculator compares running costs instantly. -

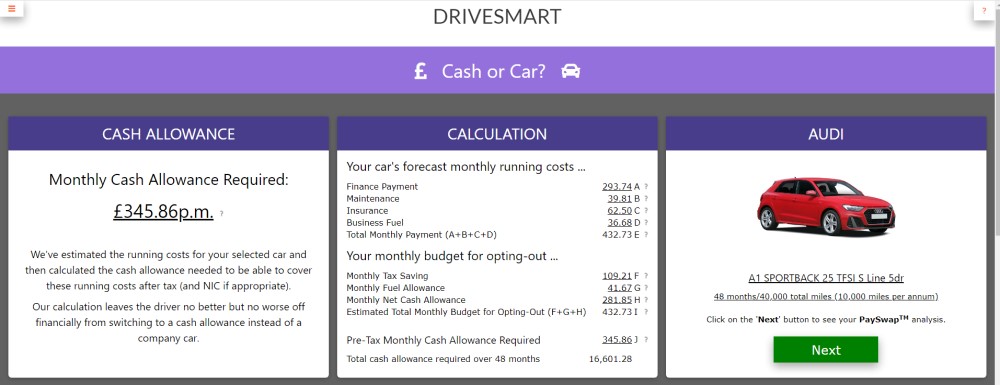

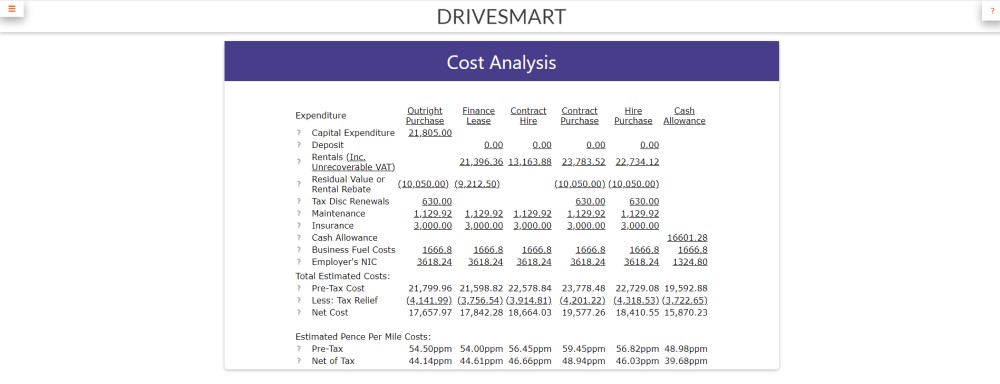

Cash or Car?

Could you give up your company car for a cash allowance? Our 'cash or car' calculator will tell you. -

Car Search

Find your next new car by monthly payment, standard equipment, performance, economy and more .... -

DriveSmart

Why not visit the DriveSmart website and see for yourself the amazing range of tools and analysis? We'll keep your place here while you browse.