DRIVESMART: The Taxman's Car Share

Get HMRC to pay for your car ....

The Taxman's Car Share

1 July 2020

You can get the taxman to pay towards your car running costs for business motoring

We explain how it works and what to do.

Tax Relief For Business Motoring

If you use your own car on business travel for your employer you will normally be eligible for tax relief on the car's running costs.

In layman's terms that means HM Revenue & Customs will give you money towards every business mile you travel in your own car.

And the more business miles you travel each tax year, the more tax relief you get.

Also, if you give up a company car and take a cash allowance instead, you will normally stop paying tax on company car benefit and instead pay tax on your cash allowance, but you can then offset some of your car's running costs against tax for each business mile travelled.

How Is Tax Relief Given for Business Motoring?

Tax relief is given through fixed pence per mile allowances which include a tax deduction for each business mile travelled during the tax year.

The system is called 'MAPs' (HMRCs' Mileage Allowance Payments).

What is MAPs?

Under 'MAPs' your employer can pay you a tax-free mileage-based allowance for using your own car for business motoring.

The allowance is intended to cover the costs of running a car, such as depreciation, maintenance, fuel, insurance and the tax disc.

Alternatively, you can claim tax relief for business motoring at the MAPs rates if you don't receive a mileage allowance or if your mileage allowance is less than the MAPs rate.

How does MAPs work?

Under the MAPs system, HMRC sets two tax-free mileage allowance rates:

- The full rate can be paid tax-free to you by your employer for the first 10,000 business miles travelled in the tax year.

- The lower rate can be paid tax-free for business mileage over 10,000 miles during the tax year.

You can find details of the current MAPs rates by clicking on this link.

If your employer pays you more than the total allowed under the MAPs scheme then the excess amount is taxed.

Why Two MAPs Rates?

HMRC considers that fixed costs such as insurance and the annual tax disc don't vary, no matter how many miles you drive each year.

As the amount of the full rate of MAPs allowance includes a proportion of these fixed costs, once you have travelled more than a certain number of business miles each tax year you will have been given tax relief in full for the fixed costs.

So, once you exceed the business mileage limit, for any travel over and above the limit you only need to be given tax relief at a lower rate to cover just the variable costs (depreciation, etc) and not the fixed costs.

In other words, you get tax relief above the business mileage limit only for the costs that continue to increase with each additional mile you travel (such as depreciation, maintenance and fuel).

Advisory Fuel Rates

HMRC also sets tax-free mileage allowance rates just to cover fuel costs incurred by employees on business motoring.

The mileage rates for cars with internal combustion engines (e.g. petrol and diesel) vary according to the type of fuel for the car and the size of the car's engine.

The mileage rate for electric cars is currently a single fixed rate for all types of electric car.

Click on this link to see the current rates.

The mileage rates can be paid tax-free, typically where:

- An employee has a company car and is being reimbursed for fuel costs on business travel.

- An employee already receives a cash allowance instead of a company car and is just being reimbursed for fuel costs on business travel.

What if I Receive a Cash Allowance?

If you receive a monthly or annual cash allowance, or a mixture of a cash allowance and a mileage based allowance, you can still claim tax relief based on the MAPs rates for the business miles you travel.

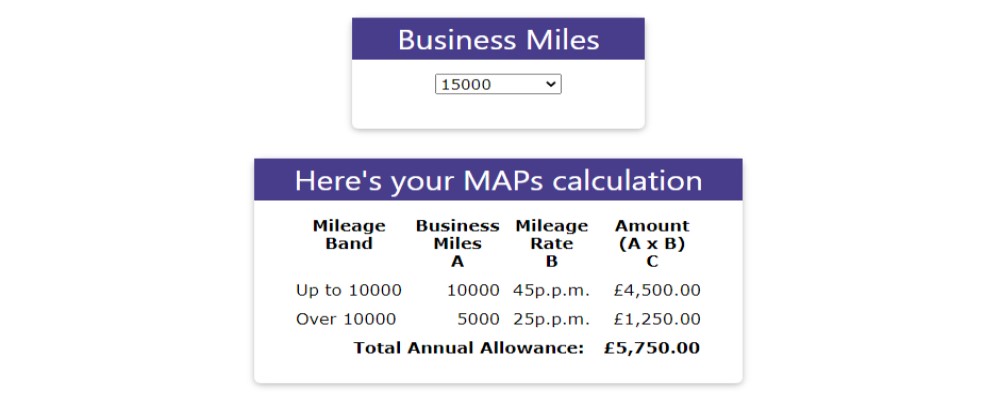

MAPs Tax Relief Example

Let's say you travel 20,000 business miles each tax year and you receive from your employer;

- a fixed cash allowance of £5,000pa; plus

- 10ppm for each business mile travelled, total £2,000pa (20000 business miles @ 10ppm).

Your employer's contribution towards your business motoring costs would then be £5,000 plus £2,000, a total of £7,000pa.

Your tax relief under MAPs would be:

- first 10,000 miles x 45p = £4,500, plus

- remaining 5,000 business miles at 25ppm = £1,250; a total of £5,750 tax relief.

As your employer pays you a total of £7,000pa and your tax relief is £5,750, out of the £7,000 you receive from your employer you would pay tax on £1,250 (£7,000 - £5,750).

Take a look at our tax relief calculator for live interactive examples.

What if I Don't Receive Any Allowances?

You do not have to actually receive a cash allowance or the MAPs allowances to benefit from them.

For example, if you receive only your salary, or your employer pays you a mileage allowance that is lower than the MAPs rate, you can opt to claim tax relief for business use of your own car using MAPs rates.

Let's say you travel 20,000 business miles in your own car during the tax year and do not receive a tax-free mileage allowance from your employer - you could then claim tax relief by reference to 10,000 miles at the full MAPs rate and 10,000 miles at the lower rate.

Alternatively, if your employer paid you a tax-free mileage allowance of only 20pence per mile for all business mileage you could claim tax relief on the difference between the total due under the MAPs rates and the actual mileage allowance received each tax year.

Can I Claim Tax Relief In Advance Under PAYE?

You do not need to wait until the end of the tax year to claim tax relief under the MAPs system.

You can make an advance claim at the beginning of the tax year for your Pay As You Earn ('PAYE') code number to be adjusted to take account of MAPs.

This can be useful if your employer pays you a monthly allowance with tax deducted (and perhaps also National Insurance Contributions) under the PAYE system.To make a claim in advance for tax relief under PAYE, simply provide your tax office with an estimate of your business mileage for the tax year and ask for your PAYE code number to be adjusted to take account of the MAPs relief to which you expect to be entitled for tax year.

Your tax code number will then be increased by the estimated tax relief due to you, which will reduce the tax that you pay through the PAYE system, in effect, giving you 1/12th of your MAPs tax relief each month.

What About National Insurance Contributions?

Normally the payment of MAPs allowances within the requirements of HMRCs' rules will qualify for exclusion from National Insurance Contributions.

In strictness, for NIC purposes there is no upper threshold on mileage for paying the full rate of MAPs allowance.

This means that you could pay the MAPs rate in full without the 10,000 mile restriction for all business mileage and not have to pay NIC on the amounts received.In practice though, employer's rarely operate a separate approach to tax and NIC as far as MAPs is concerned and typically pay the same amount for both tax and NIC purposes.

MAPs Calculator

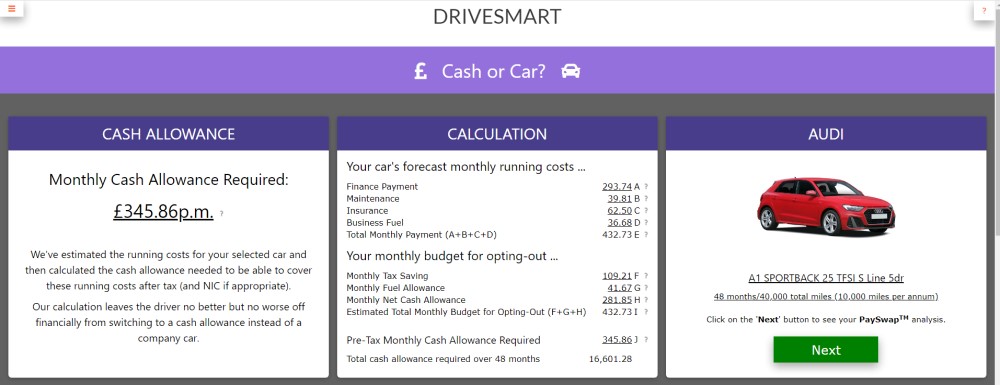

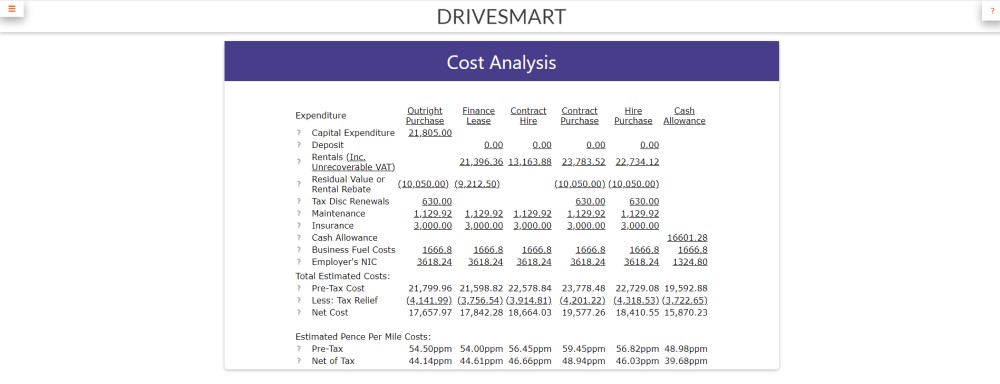

We've put together a calculator to help you compare your car's running costs to the MAPs allowance rates.

Our calculator will estimate the running costs for your next new car and then compare it to the MAPs allowance rates.

We'll show whether or not you could be out of pocket using your own car for business mileage.

Click on this link to get started.

Related Tools

Related Posts

What Else Do We Do?

DriveSmart has a unique suite of free online tools to help you find the right car.

Take a look at some of our amazing calculators and decision tools for new car buyers.

-

Lease or Buy?

Could you lease a new car for less than the cost of buying? Our lease calculator will work out the best finance method for you. -

ICE or Electric?

Would an electric car be cheaper than petrol or diesel? Our ICE or electric calculator compares running costs instantly. -

Cash or Car?

Could you give up your company car for a cash allowance? Our 'cash or car' calculator will tell you. -

Car Search

Find your next new car by monthly payment, standard equipment, performance, economy and more .... -

DriveSmart

Why not visit the DriveSmart website and see for yourself the amazing range of tools and analysis? We'll keep your place here while you browse.