DRIVESMART: Electric Company Car Tax

Make the most of special tax reductions for electric company cars

Electric Company Car Tax

27 May 2021

We explain company car tax for electric cars

Just 1% Benefit On Electric Cars

From 6 April 2021 the taxable benefit of an electric company car is just 1%.

There are some requirements, but basically the rule is that fully electric cars get taxed at 1% until April 2022 and then just 2% for the following tax year.

The 1% taxable benefit is based on the taxable list price, known as the 'P11D value' (you can read more by clicking on this link

For a full run-down of how the UK company car tax system works follow this link, but for just electric cars let's look at the specifics of how you could qualify for a 1% rate of tax on an electric company car up to 5 April 2022.

How Does It Work?

To qualify for the 1% taxable benefit rate an electric company car needs to be either:

- registered before 6 April 2020 and not emit any CO2 (for example, electric or hydrogen powered cars); or

- registered from 6 April 2020 and either;

- not emit any CO2; or

- emit less than 50GP/Km of CO2 and travel at least 130 miles on electric power only (e.g. hybrids).

Not too long ago that would have meant a fairly restricted choice of cars, but now manufacturers are all working towards expanding their ranges of electric and hybrid vehicles.

As a result, there are now over 250 models qualifying for the 1% taxable benefit, including a wide choice of body styles and equipment levels, though right now they are all electric-power only (there are two hydrogen fuel cars, but these use the hydrogen to create electricity).

At the moment we don't know of any hybrids which can meet the 130 mile requirement for travel only on electric power, but all is not lost.

Tax Reductions For Hybrids Too!

There's a sliding scale of lower taxable benefits for hybrid cars.

The level of taxation depends on when the car was registered are registered and how many miles it can manage on electric-only power.

Basically, the higher the number of miles a hybrid can travel just on electric power, the lower the taxable benefit.

Here's the scale of taxable percentage of list price for hybrid cars for 2020-21, 2021-22 and 2022-23 tax years:

CARS REGISTERED

|

|||||

CO2

|

ELECTRIC

|

PERCENTAGE OF LIST PRICE |

|||

| 2020-21 | 2021-22 | 2022-23 | |||

| 0 | N/A | 0 | 1 | 2 | |

| 1-50 | 130 or more | 2 | 2 | 2 | |

| 1-50 | 70-129 | 5 | 5 | 5 | |

| 1-50 | 40-69 | 8 | 8 | 8 | |

| 1-50 | 30-39 | 12 | 12 | 12 | |

CARS REGISTERED

|

||||

CO2

|

ELECTRIC

|

PERCENTAGE OF LIST PRICE |

||

| 2020-21 | 2021-22 | 2022-23 | ||

| 0 | N/A | 0 | 1 | 2 |

| 1-50 | 130 or more | 0 | 1 | 2 |

| 1-50 | 70-129 | 3 | 4 | 5 |

| 1-50 | 40-69 | 6 | 7 | 8 |

| 1-50 | 30-39 | 10 | 11 | 12 |

| 1-50 | Below 30 | 12 | 13 | 14 |

Some of the Company Car Benefit reductions for hybrids are substantial.

To put the above numbers into perspective, before the tax changes the 2019-20 taxable percentage of list price for all cars which met above requirements was 16%.

This means that hybrids could qualify for a significant reduction in Company Car Benefit compared to the benchmark 2019-20 tax year.

Watch for the Gotcha!

Take a careful look at the two tables.

If you registered a qualifying hybrid company car before 6 April 2020 you'll get a bigger reduction in your Company Car Benefit for the next three tax years than if you waited until 6 April 2020.

That means buying used rather than new, as we've already passed the 6 April 2020 target date.

However, as hybrid technologies improve you might find that new hybrid company cars with longer electric-only ranges are released and get that these get you into the 'magic' 130 mile 'electric-only' range qualification.

Not Just Tax Savings

Because of the way that employer's National Insurance Contributions (NICs) on company cars are calculated, the new rules mean that employers could also save NICs from employees switching to electric cars or hybrids.

Employer's NICs are based on the same value as the Company Car Benefit for the employee, so if an employee gets an electric car with a 1% taxable benefit (or a hybrid with a high electric-only range) which is registered before 6 April 2023 then his /her employer will save on NICs as well.

The Losers

Drivers who take a cash allowance instead of a company car could find they are losers from the new taxable benefit rates.

If their employer starts to benchmark the cash allowance against cars which qualify for the new super low taxable benefits, this could cut the tax savings the employees get from taking a cash allowance.

Employees should always take into account the tax savings from opting out of a company car when calculating the true spending power of their cash allowance.

If the tax liability on a benchmark company car drops, so does the spending power of the employee's cash allowance.

If that all sounds horribly complicated then try our 'cash or car' calculator to see the effect on you.

Keep Coming Back

We'll be updating our company car tax calculator as new models are released, so keep checking there to see the latest tax calculations.

Related Tools

Related Posts

What Else Do We Do?

DriveSmart has a unique suite of free online tools to help you find the right car.

Take a look at some of our amazing calculators and decision tools for new car buyers.

-

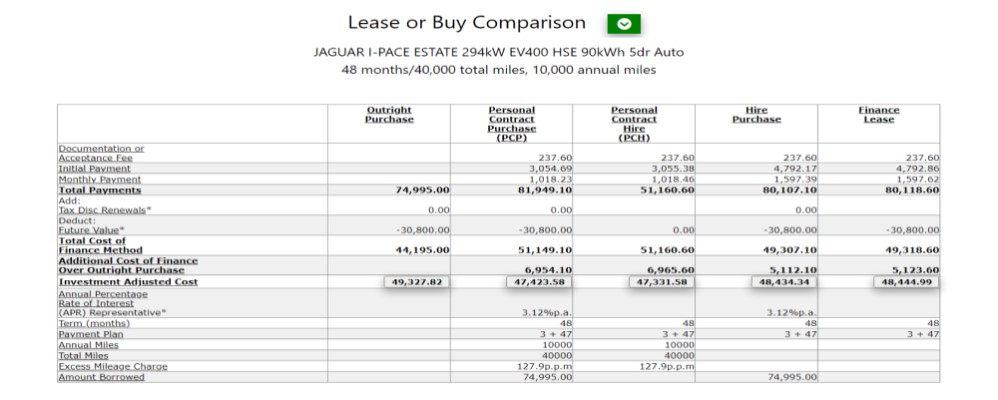

Lease or Buy?

Could you lease a new car for less than the cost of buying? Our lease calculator will work out the best finance method for you. -

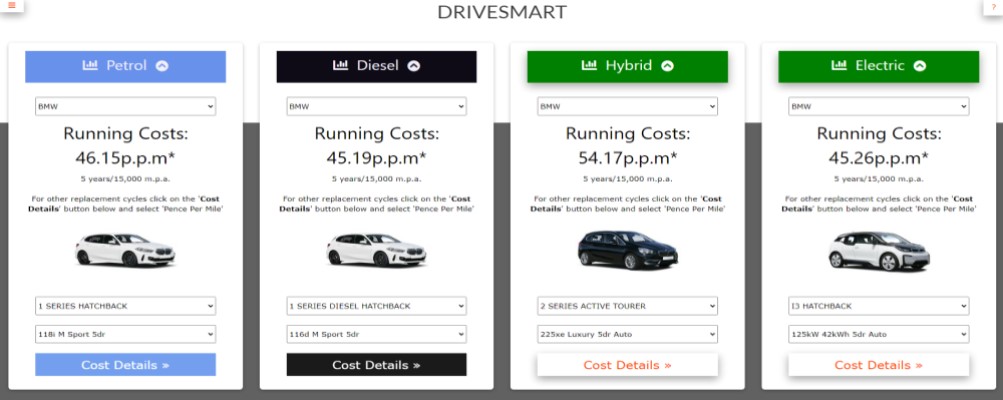

ICE or Electric?

Would an electric car be cheaper than petrol or diesel? Our ICE or electric calculator compares running costs instantly. -

Cash or Car?

Could you give up your company car for a cash allowance? Our 'cash or car' calculator will tell you. -

Car Search

Find your next new car by monthly payment, standard equipment, performance, economy and more .... -

DriveSmart

Why not visit the DriveSmart website and see for yourself the amazing range of tools and analysis? We'll keep your place here while you browse.