DRIVESMART: Electric Car Finance

Stick with traditional car finance or try something different?

Electric Car Finance

1 September 2020

We explain your finance options for an electric car

What's The Best Way To Finance An Electric Car?

Financial risk from excessive depreciation or maintenance costs is a fundamental part of the costs of ownership for any car, but there are finance methods which can limit your risk and even give you a 'win-win' if you explore finance beyond a simple bank loan or hire purchase deal.

More recent developments in car finance mean that you can effectively bet against a drop in second-hand car values and insure yourself against unforeseen maintenance costs.

How so? Well, let's look at finance first.

Two finance products in particular have gained ground in the new car market; Personal Contract Purchase ('PCP) and Personal Contract Hire ('PCH').

So let's take a look at the pros and cons of both.

Personal Contract Purchase

In a PCP agreement you only pay for depreciation and interest charges. A finance period is agreed (let's say 3 years) and the vehicles value in 3 years' time is fixed assuming you use it for an agreed number of miles and keep the car in a condition appropriate for its age and mileage.

Advantages

Because the vehicle's value at the end of the agreement is fixed you know the minimum you will get for it when you finish the repayments.

If the car is worth more at the end of the agreement than the forecast value you can keep the difference or use it as a deposit towards a new vehicle.

If the car is worth less than the forecast, and it's not because you didn't look after the car or exceed the agreed mileage, then the dealer or finance company takes the loss - you just hand back the car.

Disadvantages

You can't sell the car before the end of the contract without incurring a financial penalty.

If you exceed the agreed contract mileage or hand back the vehicle with excessive wear and tear you will incur financial penalties.

You repay less of the purchase price in each monthly payment so interest charges are higher than bank loans or hire purchase.

Personal Contract Hire

In a PCH agreement you are just renting your electric car rather than buying it, and at the end of the PCH agreement you simply hand it back.

Advantages

The leasing company recovers VAT on the price of the vehicle so the lease rentals for cars are lower than comparable business or personal contract purchase.

You avoid some of the normal responsibilities of ownership, such as sourcing the best deal and haggling for the best resale (or 'residual') value.

You can swap to a new car every 2-4 years to keep pace with developments in battery and other in-car technology.

If the car is worth less than expected at the end of the lease then that's the leasing company's problem (as long as it's not because of excessive wear and tear or mileage).

Disadvantages

Deposits can be as high as 9 x the monthly lease rentals.

If you terminate the lease early you will have to pay a penalty (usually a number of months rentals).

If the vehicle is returned with more than the agreed mileage or with excessive wear and tear then 'end of contract' charges may be made by the leasing company.

If the car is worth more than expected at the end of the lease then the leasing company keeps any 'profit'.

Subscription - The New Kid On The Block

A new type of finance has evolved in the electric car era - Subscription.

In a Subscription deal you pay one all-inclusive fee each month and this covers:

- Depreciation

- Finance costs

- Maintenance

- Insurance

- Optionally: Recharging

Advantages

You pay a monthly rental to cover all your costs of using a car.

You can cancel the subscription and just hand back the vehicle.

You can swap to a new car whenever you want to keep pace with developments in battery and other in-car technology.

You get a fixed monthly 'allowance' of inclusive mileage and can top-up or 'roll-over' mileage if necessary.

Disadvantages

Monthly payments are a lot more expensive than traditional electric car finance or leasing.

If the vehicle is damaged outside the insurance terms you are liable for the repair costs.

Recharging points may be limited to those operated by the subscription company or its affiliates.

Usage restrictions may apply to limit how you drive 'your' electric car and 'black-box' telematics may report on your driving behaviour.

The jury is still out on the Subscription approach and getting information about Subscription deals isn't easy, with suppliers keeping their cards close to they chests and providing Subscription quotes only on a 'one-to-one' basis.

Outright Purchase

Buying a car outright from your own savings is the simplest way to finance a car, assuming you have the spare cash.

And given that investment returns on cash left in the bank or building society aren't producing particularly high rates of return at the moment, outright purchase may well save you money on interest charges compared to a finance deal.

Advantages

Buying outright is the simplest way to fund a new electric car or van.

Keep the vehicle as long as you want and run it up to any mileage.

Technically you can 'profit' from looking after the vehicle well and achieving a better resale price than the normal market value.

Vehicles can be sold at any time without a specific financial penalty (leasing companies usually charge a penalty for ending a lease contract early).

Businesses can get 100% tax relief on an EV in the tax year of purchase.

Disadvantages

You are exposed to changes in market values and maintenance costs, in particular if used vehicle prices drop.

Money tied up in the car or van can't be accessed without either selling it or pledging it as security for a loan.

You lose the use of money that could be invested elsewhere and your 'rainy day' cash pile is depleted.

Which Way Do You Go?

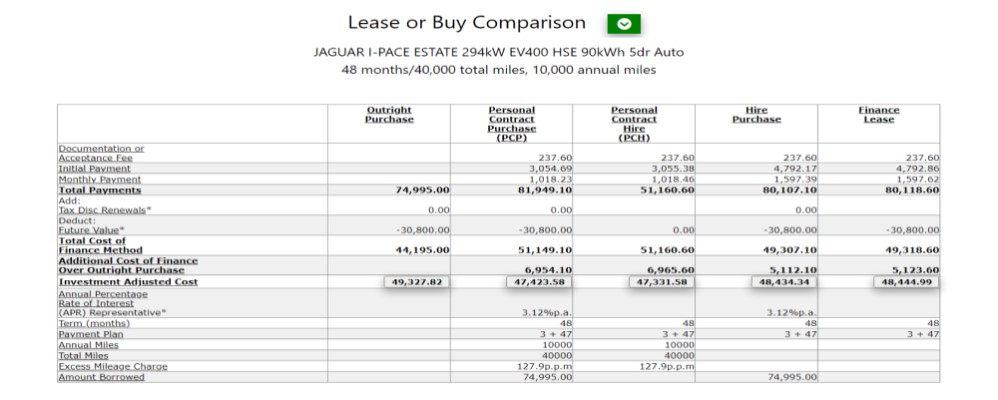

You can compare outright purchase, PCP and PCH for your electric car using our 'Lease or Buy' calculator.

For the moment our calculator sticks with comparing outright purchase, PCP and PCH as information on Subscriptions is hard to come by. As soon as this changes we'll be adding Subscriptions to our cost comparison model.

Related Tools

Related Posts

What Else Do We Do?

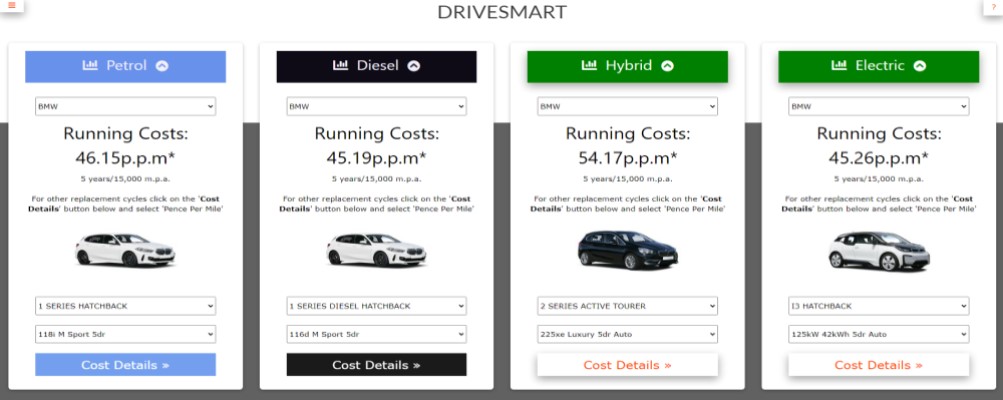

DriveSmart has a unique suite of free online tools to help you find the right car.

Take a look at some of our amazing calculators and decision tools for new car buyers.

-

Lease or Buy?

Could you lease a new car for less than the cost of buying? Our lease calculator will work out the best finance method for you. -

ICE or Electric?

Would an electric car be cheaper than petrol or diesel? Our ICE or electric calculator compares running costs instantly. -

Cash or Car?

Could you give up your company car for a cash allowance? Our 'cash or car' calculator will tell you. -

Car Search

Find your next new car by monthly payment, standard equipment, performance, economy and more .... -

DriveSmart

Why not visit the DriveSmart website and see for yourself the amazing range of tools and analysis? We'll keep your place here while you browse.