DRIVESMART: Time To Rejoin Your Company Car Scheme?

We explore reversing back into a company car ....

Time To Rejoin Your Company Car Scheme?

23 September 2020

Is an EV tempting you to rejoin the company car scheme?

We explain how to reverse back into a company car plan.

HMRC statistics suggest that company car numbers have recently been dropping by about 50,000 each tax year as the popularity of taking a cash allowance has grown.

But if you took a cash allowance instead of a company car and your business mileage has been slashed due to COVID-19, your tax bill could be creeping up right now.

So would the 0% tax on an electric company car tempt you to rejoin the company car scheme?

We explain how to reverse back into a company car plan and how much you could save.

Should I Really Be Going Back?

It doesn't seem that long ago company car drivers began to boldly go where no company car drivers had gone before and take cash allowances instead of company cars.

And yet now there is the prospect of that forward motion into cash allowances being reversed.

Why?

Because company car tax has dropped to 0% on electric cars (or more properly, zero emissions cars, as hydrogen fuelled electric cars ('HEVs') qualify as well as plug-in battery electric vehicles or 'BEVs').

As a result, employees who dropped out of company cars in favour of cash allowances could see the 'remainers' who get a BEV begin to benefit significantly, having previously suffered continual erosion of the company car as a perk through higher company car benefit rates.

Why is all that important?

Well, company cars gained a foothold in the UK pay and benefits market in the 1970s, both as a tax efficient perk and a way around pay restraint legislation designed to help combat the UK's runaway inflation of the 70s and 80s.

Given that cash allowances are taxed at an employee's highest tax rate and could, possibly, push an individual over a tax threshold (e.g. from 20% to 40%), swapping to a tax free perk could be considered 'a good thing'.

How Would It Work?

First of all your employer will have to agree to it.

However, your employer may not necessarily take much pursuading.

The 0% rate applies to the company car benefit, not to the tax due on it, so employers see a 0% national insurance contributions liability on the company car benefit too.

But there are some practical obstacles to be overcome, not least:

- Your existing car contract

- The legal details

- Recharging at work

- The car you choose

- The Government's coffers

Your existing car contract

Assuming you financed your own car, it's unlikely that you would be let out of your finance contract early without penalties, so if you are only just into a new car contract these could be prohibitive.

It could make more sense to wait until your car contract is up for renewal anyway and then make a swap back to a company car.

The legal details

Your employer probably took some time and legal advice to make changes to your employment contract to allow you to swap to a cash allowance.

For tax reasons those contract changes typically had to be one way.

Allowing employees to swap back and forth between company cars and cash allowances is bad news from a general tax perspective.

Employees can become liable to the higher of the tax on the car or the cash allowance (no matter which route the employee takes), so a route around this adverse tax effect would need to be put in place with your employer.

Recharging at work

Whilst battery technology is improving all the time, you need to consider carefully the implications of recharging at work.

That's not necessarily recharging at the office (though if your employer has provided recharging stations at the office then that's very helpful, both for you and the environment).

Remember that you will now have to plan business journeys so that you can either make it to your destination and back on a single charge, or be able to find an available charger at your destination to 'refill' before setting off home.

The car you choose

At the moment EVs are in short supply, and although the situation is likely to improve, battery shortages and the technological barriers to EV production mean that electric company cars will still be a rarity for a while until supply catches up with demand.

You could go part way by swapping to a hybrid car - depending on the battery range of the hybrid you could easily halve your tax bill on a company car - but you won't see the absolute zero tax bill of an EV.

The Government's coffers

The 0% taxable benefit for electric company cars was announced in the world that existed before COVID-19.

However, in COVIDLand things may change on the taxable benefit front as the Government tries to recoup some of the enormous costs of supporting the economy during recent times.

There are already marginal increases planned in company car benefit for EVs.

Currently assessed at 0% of taxable list price, from April 2021 the taxable benefit will be 1%, and 2% from April 2022.

And the advantages of electric company cars could be eroded or wiped out entirely if the Govermment needs to find money to refill its coffers.

That would leave you back in a company car plan sitting waiting for your employer's contract for your new EV to expire before you can look at the feasibility of getting back out again into a cash allowance.

How Much Will I Save?

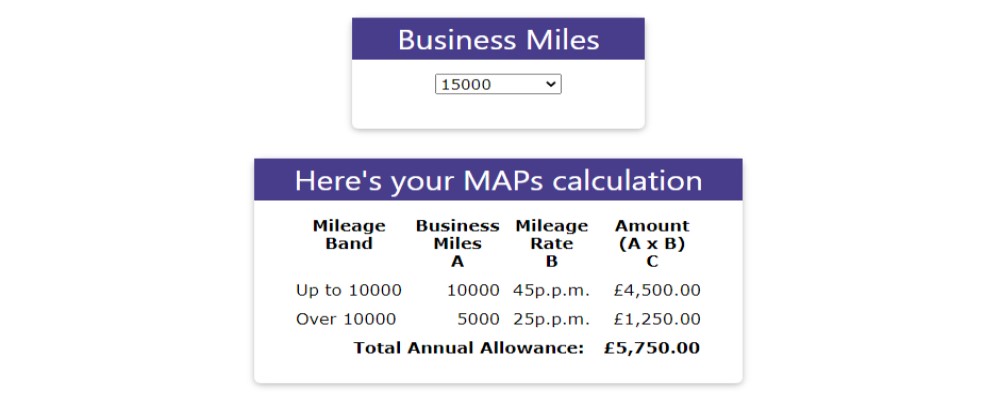

When you swapped to a cash allowance you left behind the company car benefit regime and swapped to 'MAPs', HM Revenue & Customs' tax-free Mileage Allowance Payments.

You can read all about MAPs here, but basically you switched to a system that rewarded you with tax deductions according to the number of business miles travelled each tax year.

So, what's likely to be the tax saving from rejoining your company car scheme?

First of all, remember that the 0% saving only applies until 5 April 2021 and we're already about half way through the 2020/21 tax year.

Secondly, your tax saving will depend on how much you get as a cash allowance, how your employer reimburses you for business miles and your actual business mileage each tax year.

As an example though, let's assume a cash allowance recipient getting:

- A monthly cash allowance of £500

- 10,000 business miles each year with tax relief at the MAPs rates

- 40% income tax rate and earning over the NIC limit

- reimbursement for business fuel costs at 10p per mile*

Tax Calculation

| Cash Allowance | 500.00 |

| Mileage Allowance (fuel only) | 100.00 |

| Total Allowance | 600.00 |

| Tax relief (MAPs) | 408.33 |

| Taxable Allowance | 191.67 |

| Tax rate | 40% |

| Tax due | 76.67 |

| Net allowance | 523.33 |

In this example, swapping to an EV now, the tax saved would be £76.67 per month.

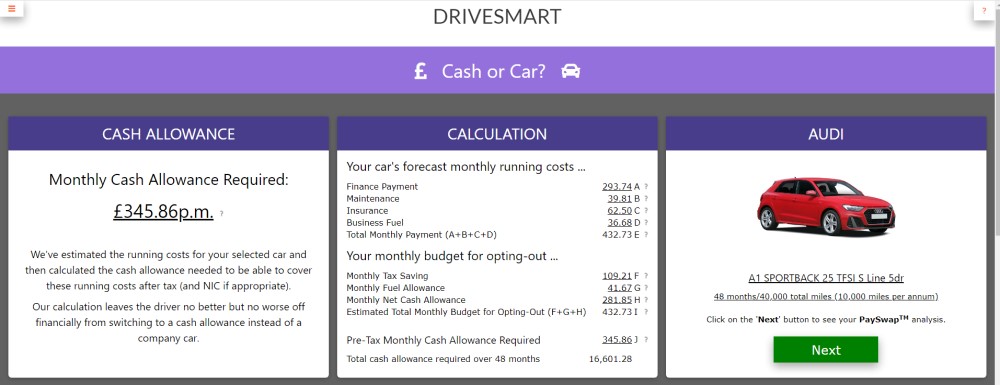

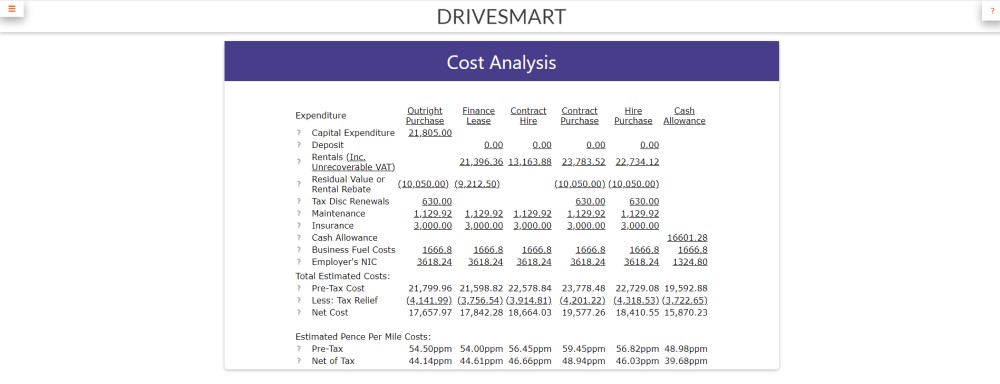

To see a more detailed calculation of the tax saving head over to our online cash or company car tool and run through a calculation using your current non-electric car.

Meanwhile ...

You can check the battery range, recharge times and tax liabilities of electric company cars and hybrids with our online tools.

Click on this link for the new 0% tax rules.

If you want to know whether an EV will manage your daily business mileage without a recharge this link for EV battery range details.

Related Tools

Related Posts

What Else Do We Do?

DriveSmart has a unique suite of free online tools to help you find the right car.

Take a look at some of our amazing calculators and decision tools for new car buyers.

-

Lease or Buy?

Could you lease a new car for less than the cost of buying? Our lease calculator will work out the best finance method for you. -

ICE or Electric?

Would an electric car be cheaper than petrol or diesel? Our ICE or electric calculator compares running costs instantly. -

Cash or Car?

Could you give up your company car for a cash allowance? Our 'cash or car' calculator will tell you. -

Car Search

Find your next new car by monthly payment, standard equipment, performance, economy and more .... -

DriveSmart

Why not visit the DriveSmart website and see for yourself the amazing range of tools and analysis? We'll keep your place here while you browse.